On October 16th, the SEC announced that it approved final rule amendments to revise certain auditor independence requirements in Rule 2-01 of Regulation S-X. In May 2018, the SEC welcomed suggestions for other revisions to the independence requirements in its proposed rule for Auditor Independence with Respect to Certain Loans or Creditor/Debtor Relationships, which resulted in the December 2019 Proposing Release for Amendments to Rule 2-01. The initial independence requirements were adopted in 2000 with amendments last updated in 2003.

The new rule reflects decades of SEC staff education and experience using the auditor independence framework amid fluctuating capital market conditions. The final amendments reflect the SEC’s long-held belief that an audit by an objective, skilled professional contributes to both investor protection and investor confidence by directing audit clients, audit committees, and auditors to areas that may threaten an auditor’s objectivity and impartiality. The amendments revise the rules to concentrate the independent analysis more effectively on relationships and services that may threaten an auditor’s neutrality. These relationships have either caused non-substantive rule breaches or required potentially extensive audit committee review of non-substantive matters, which diverts time, attention, and other resources of audit clients, auditors, and audit committees that could have been devoted to investor protection efforts.

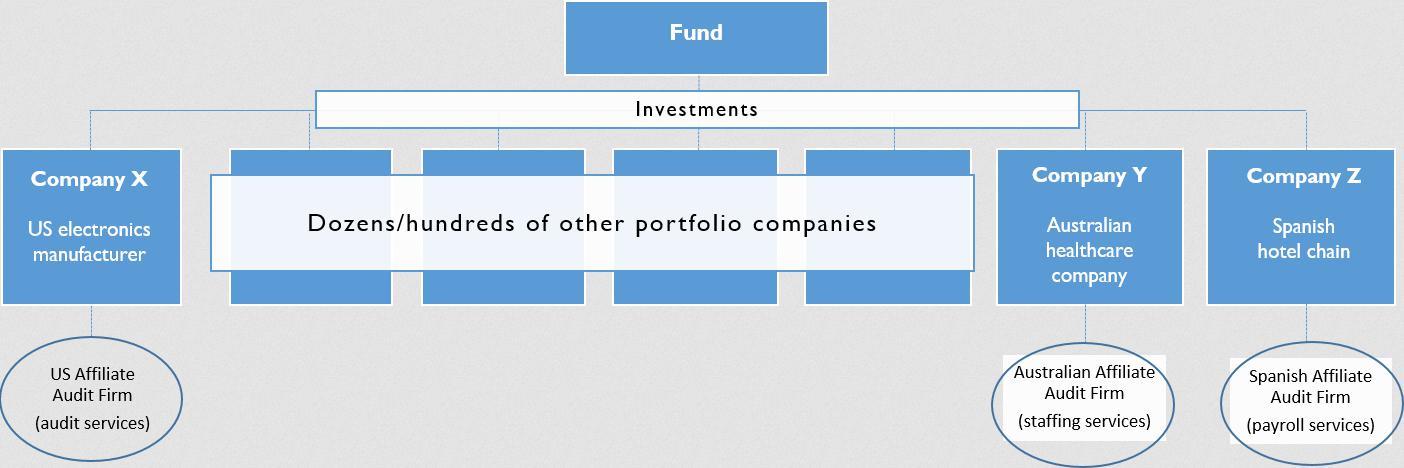

The final amendments seek to focus the auditor independence rules on relationships and services that are more likely to jeopardize the objectivity and impartiality of auditors. The following examples, partly based on the SEC staff’s consultation experience, help to illustrate some of the concerns with the prior rules that the modified amendments address.

Example 1 – Student Loans

Audit Firm employs an audit partner living in Atlanta who pays student loans taken before working at Audit Firm. Another audit partner in Atlanta audits the student loan company that provided the loan. Under prior amendments, the student loan of the audit partner, although not part of the audit, would lead to an independence violation for the audit engagement of the lender. Under the revised amendments, the student loan would no longer result in an independence violation for the audit engagement of the lender.

Example 2 – Portfolio Companies

Assume Company X is a U.S.-based portfolio company of Fund F. Fund F invests in Company X and a large variety of companies worldwide. Audit Firm A is the auditor of Company X. Also assume that two of Audit Firm A’s international network affiliates provide the services to two separate portfolio companies of Fund F, Company Y and Company Z. Presume that Company Y and Company Z share no connection to each other or to Company X except that Fund F is invested in each Company. To add practical context, consider that:

- An Australian affiliate of Audit Firm A provides limited staffing services for a short time to Company Y, a healthcare portfolio company based in Australia.

- A Spanish affiliate of Audit Firm A provides payroll services for a short time to Company Z, a lodging (hotel chain) portfolio company based in Spain.

- Company X has its own separate governance structure unrelated to Company Y or Z, and Company Y and Z are not material to Fund F.

Under the auditor independence rules prior to the recent revisions, if Company X registers with the SEC (for example, by conducting an initial public offering), Audit Firm A would not be independent of Company X as a result of the services provided to Company Y or Z. This is the case when, as the SEC staff has observed in similar situations, these limited services at immaterial portfolio companies (like Companies Y and Z) have no impact on the entity under audit and do not influence the objectivity and impartiality of the auditor conducting the audit for Company X.

Prior to recent amendments, the rule mandated that Company X:

- replace Audit Firm A with another audit firm

- wait to register with the SEC for up to three years after termination of the services provided to Company Y and Company Z

- decide that the rule violation did not impair the auditor’s objectivity and impartiality, likely in consultation with SEC staff and/or the audit committee

In some instances, the current audit firm is unable to be replaced because all other qualified audit firms have provided services or established other relationships with portfolio companies of Fund F that caused a breach of the SEC’s independence rules. The issue of the independence rule affecting auditor choice is underscored by this example and has increased substantially as the asset management industry has grown, investments have become more international, and the worldwide audit services ecosystem has consolidated and become more specialized.

Under the modified rules, Company X would be permitted to engage Audit Firm A for audit services. In recent years, the SEC staff led a number of consultations in which this and similar fact patterns were raised to the SEC staff by the registrant’s audit committee and its auditor. In these situations, the SEC staff did not oppose the auditor’s and the audit committee’s conclusion that the auditor’s objectivity and impartiality would not be compromised. Over the past decade, SEC staff has provided similar feedback in these types of scenarios. The amended rules would alleviate the need for registrants’ audit committees and their auditors to seek SEC staff guidance in these scenarios.

The modernized auditor independence requirements will also:

- amend the definitions of “affiliate of the audit client,” in Rule 2-01(f)(4), and “investment company complex,” in Rule 2-01(f)(14), to address certain affiliate relationships, including entities under common control

- revise the definition of “audit and professional engagement period,” specifically Rule 2-01(f)(5)(iii), to shorten the look-back period, for domestic first-time filers in assessing compliance with the independence requirements

- amend Rule 2-01(c)(1)(ii)(A)(1) and (E) to add certain student loans and minor consumer loans to the categorical exclusions from independence-impairing lending relationships

- modify Rule 2-01(c)(3) to replace the reference to “substantial stockholders” in the business relationships rule with the concept of beneficial owners with significant influence

- replace the outdated transition provision in Rule 2-01(e) with a new Rule 2-01(e) to introduce a transition framework to address inadvertent independence violations that only arise as a result of a merger or acquisition transactions

- improve competition and audit quality by increasing the number of qualified audit firms that issuers can choose from

Auditors may not retroactively apply the final rule to relationships and services in existence before the effective date or the early compliance date if chosen by an audit firm. Voluntary early compliance is allowed after the amendments are published in the Federal Register before the effective date if the final amendments are applied in their entirety from the date of early compliance. The amendments will be in effect 180 days following publication in the Federal Register.

Sources:

SEC Updates Auditor Independence Rules (sec.gov)

Qualifications of Accountants (sec.gov)